Paying sales tax is part of running any business, and for those who live or work in Oklahoma, staying on top of the local tax rates is important. Whether you are selling goods, offering services, or shopping in different cities across the state, understanding what you owe is essential. The

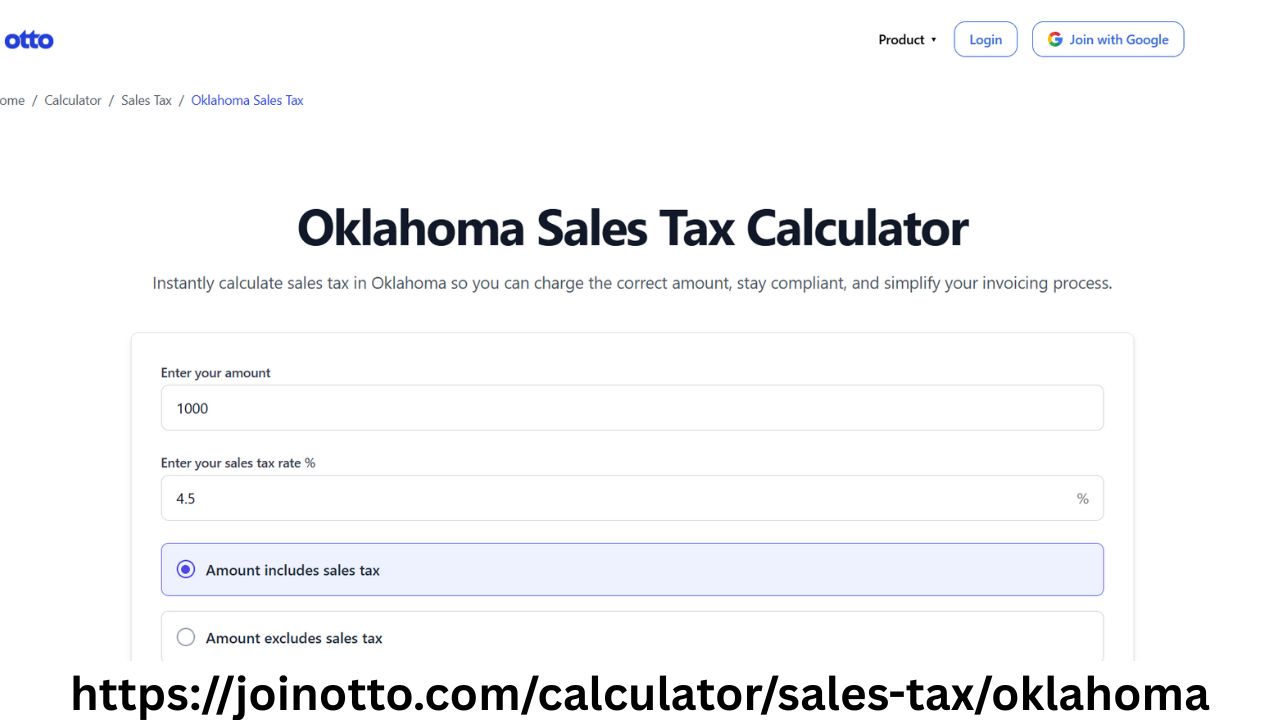

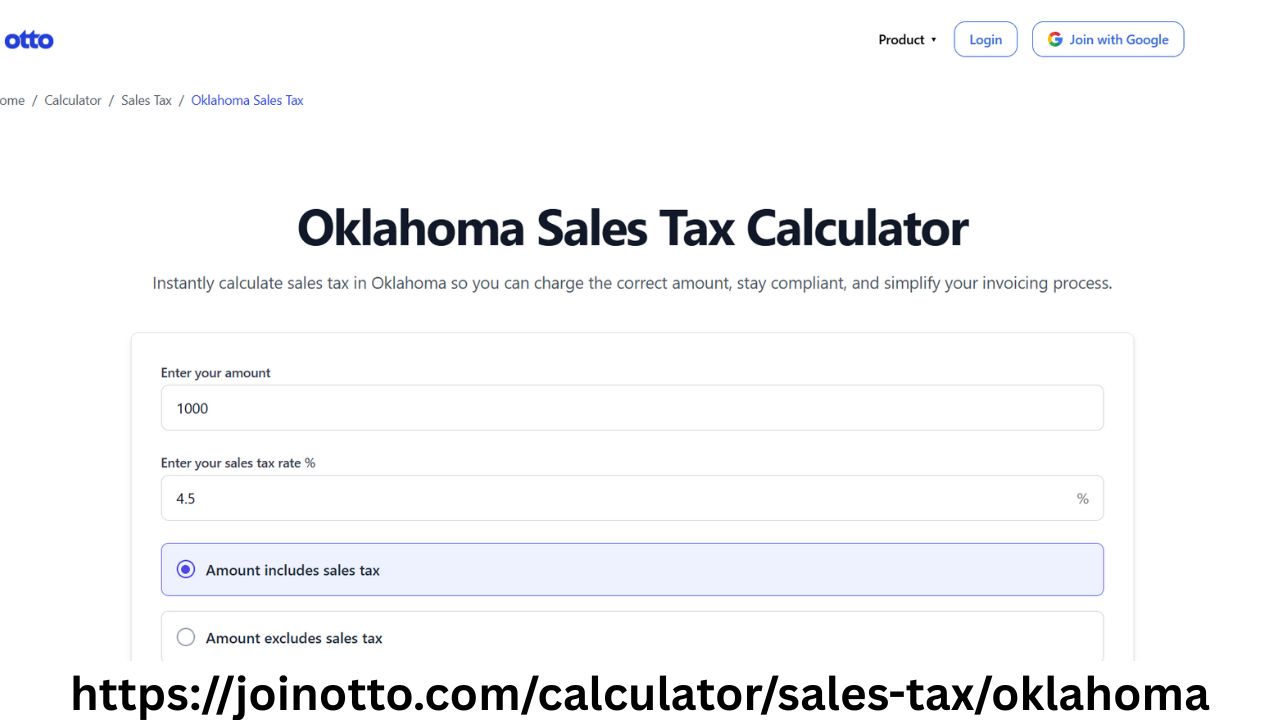

Oklahoma Sales Tax Calculator makes this process much easier and more accurate. If you want a tool that saves time and reduces stress, then this blog will help you see how useful the right calculator can be.

In Oklahoma, sales tax is made up of a state base rate plus local city and county taxes. This means that the amount you pay can vary depending on where you are located. For example, buying something in Oklahoma City may result in a different tax amount than if you were in Tulsa or Norman. Having a sales tax calculator Oklahoma tool helps you find the exact total in seconds. It removes all the guesswork and makes sure you’re charging or paying the right amount.

Running a business or working for yourself means handling lots of daily tasks. From invoices to customer service, you already have plenty to manage. Adding up sales tax manually for every sale can slow you down and lead to errors. A tool like the Oklahoma City sales tax calculator helps you avoid that. You just enter the amount, choose your location, and instantly get the tax amount and final total. This means more accuracy, fewer mistakes, and better confidence in your numbers.

When you use a sales tax in Oklahoma calculator, you can quickly find out how much tax needs to be added to your product or service price. If you are selling something for $100 in Oklahoma City, and the total tax rate there is 8.625%, the calculator will instantly show you that the tax is $8.63, and your customer should be charged $108.63 in total. You don’t have to memorize tax rates or search online each time—it’s all done for you.

This also helps when making purchases for your business. If you are buying office supplies, equipment, or services and want to stay within a budget, knowing the final cost including sales tax can help you plan better. The Oklahoma Sales Tax Calculator lets you check prices in advance and avoid surprises at checkout.

Otto AI offers a helpful and user-friendly calculator designed for Oklahoma residents and business owners. It gives real-time tax results based on your city and the amount you enter. You don’t have to be a math expert or accountant to use it. Everything is laid out clearly, and results are easy to read and use. Whether you’re a local shop owner or an online seller shipping products across Oklahoma, this tool can save you time and effort.

Another benefit of using this calculator is that it keeps up with tax changes. Sales tax rates can sometimes change based on city council or county rules. If you’re not checking for updates regularly, you could charge the wrong amount without even knowing. But using a trusted tool ensures you’re always working with the most current rates. The sales tax calculator Oklahoma saves you from tracking those changes manually.

Many people also use the Oklahoma City sales tax calculator to compare prices when shopping in different parts of the state. If one city has a lower rate than another, it might help you decide where to buy. Even a small difference in tax can add up, especially when purchasing in large quantities. It’s a smart way to keep your spending under control.

Freelancers and self-employed professionals often have clients in different cities. When sending out estimates or invoices, using a sales tax in Oklahoma calculator ensures your numbers are accurate no matter where your client is. You avoid undercharging or overcharging, and your business looks more professional.

The calculator also works well during tax season. When it’s time to report your income and sales taxes to the government, you need clear and accurate records. Having used a calculator to charge the right amounts all year long will make things easier. You’ll be able to pull up your totals and feel confident that your tax numbers are correct.

Let’s say you run an online clothing store from your home in Tulsa. Customers place orders from all over Oklahoma. Instead of trying to figure out each city’s tax rate yourself, you can use the Oklahoma Sales Tax Calculator to instantly get the correct amount for each location. This keeps your prices fair and your taxes in order.

Otto AI built this tool with everyday users in mind. The layout is simple, the steps are few, and the results are clear. There are no confusing forms or extra steps. Just type in your amount, select the location, and you get your result right away. Even if you’re new to running a business, this tool makes it easy to get things right from the start.

When customers see a clear breakdown of costs, they feel more confident buying from you. Using a reliable Oklahoma City sales tax calculator adds that transparency to your invoices or receipts. It shows that you care about accuracy and fairness, and that can build stronger trust with your clients or shoppers.

In the end, whether you are a self-employed artist, a retail store owner, or someone who makes a few extra sales each month, having access to a simple and reliable sales tax calculator Oklahoma tool makes a big difference. It helps you work faster, avoid mistakes, and stay on the right side of tax rules.

To sum up, the Oklahoma Sales Tax Calculator is a helpful tool for anyone who needs to calculate tax accurately and quickly. It gives you control over your pricing, makes reporting easier, and supports smooth business operations. And when you use a trusted option like the one offered by Otto AI, you know you’re working with a tool that fits your needs. Try it out and make your tax tasks easier, one calculation at a time.

Leave a Comment