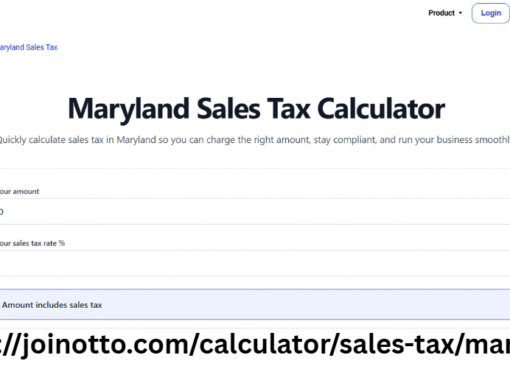

The Ultimate 2025 Guide to Getting Your Token Listed on CoinList

Listing a token on a reputable platform like CoinList is a critical milestone for blockchain projects seeking visibility, credibility, and investor trust. CoinList is widely recognized for supporting innovative projects while maintaining rigorous compliance and security standards. Successfully navigating the listing process not only introduces your token to a global audience but also establishes a strong foundation for long-term growth and adoption. This guide provides a detailed roadmap for projects looking to list their tokens on CoinList in 2025, covering technical preparation, marketing strategies, compliance, and post-listing practices to ensure sustained success.

Why CoinList Is a Preferred Platform

CoinList is not just an exchange; it serves as a trusted launchpad for blockchain projects seeking legitimacy and investor engagement. The platform is known for its rigorous vetting process, strong regulatory compliance, and commitment to security. For token projects, listing on CoinList provides access to a global investor base, which can significantly enhance visibility and liquidity. Understanding the platform’s advantages helps projects prepare effectively and leverage CoinList’s resources to maximize the potential of their token launch. This section explains why CoinList has become a top choice for blockchain developers aiming for a successful market debut.

-

Reputation and Trust: CoinList has a proven track record of successfully supporting high-quality blockchain projects while ensuring regulatory compliance. This enhances investor confidence in newly listed tokens.

-

Access to Global Investors: By listing on CoinList, projects gain exposure to a worldwide network of investors actively seeking innovative digital assets.

-

Security and Compliance Standards: The platform emphasizes KYC (Know Your Customer) and AML (Anti-Money Laundering) protocols, ensuring the integrity and safety of token sales.

-

Market Credibility: Being listed on a recognized platform like CoinList can pave the way for future partnerships and listings on other exchanges, increasing long-term adoption.

Preparing Your Token for Listing

Proper preparation is the foundation of a successful token listing. CoinList evaluates projects comprehensively, including technical readiness, legal compliance, and strategic planning. Developers must ensure that the token is fully operational, smart contracts are audited, and the overall infrastructure is secure. Legal compliance with securities and digital asset regulations is critical to avoid delays or rejection. Well-prepared documentation, including a whitepaper and roadmap, demonstrates transparency and builds investor trust. Additionally, a detailed tokenomics plan is essential to show long-term viability. Investing time in preparation enhances credibility and increases the likelihood of approval and a successful launch on CoinList.

-

Technical Readiness: Ensure smart contracts are fully audited and the token infrastructure is tested thoroughly. Any vulnerabilities can delay or prevent listing approval.

-

Regulatory Compliance: Work with legal experts to ensure your token adheres to all applicable laws, including securities regulations and local legal frameworks.

-

Comprehensive Documentation: A detailed whitepaper and clear project roadmap demonstrate transparency and help investors understand your token’s purpose, utility, and long-term vision.

-

Tokenomics Strategy: Presenting a robust token distribution plan and economic model helps establish the sustainability and credibility of your project.

Step-by-Step Guide to CoinList’s Listing Process

CoinList follows a well-defined process to ensure that only credible and compliant tokens reach investors. Understanding the listing process is essential to prepare the necessary documentation and meet all platform requirements efficiently. The process begins with a detailed application submission, followed by rigorous due diligence that reviews technical audits, legal compliance, and project feasibility. CoinList also considers community engagement and marketing efforts when assessing a project. Once approved, the platform schedules the token launch and coordinates with the team to ensure a smooth rollout. Awareness of this process allows projects to plan effectively and avoid delays during listing.

-

Application Submission: Start with a formal application, providing accurate business, legal, and technical documentation. Transparency at this stage sets the tone for the review process.

-

Due Diligence and Review: CoinList evaluates audits, legal compliance, team credibility, and project feasibility. This step ensures that only reliable tokens reach investors.

-

Community and Marketing Assessment: The platform considers your project’s community support and engagement, which can positively impact the listing approval.

-

Launch Scheduling: After approval, CoinList coordinates with your team to schedule the token sale or listing, ensuring all systems are tested and secure.

Building a Strong Community and Investor Base

A token launch’s success depends heavily on an engaged and informed community. Investors are more likely to support projects that maintain transparency, provide clear communication, and demonstrate consistent progress. Community engagement should begin well before the token listing, incorporating educational content, AMAs, and social media interaction. Maintaining transparency about token distribution, roadmap milestones, and development updates builds credibility and trust. Marketing initiatives, including strategic partnerships and influencer collaborations, can significantly expand reach and visibility. A strong community ensures not only initial adoption but also sustained interest and participation in the token post-listing.

-

Community Engagement: Host educational sessions, AMAs (Ask Me Anything), and provide clear updates to keep investors informed and involved.

-

Transparency: Regular communication on project milestones, token distribution, and development progress builds trust and confidence.

-

Strategic Marketing: Collaborate with partners, media outlets, and influencers to increase visibility and credibility in the crypto community.

-

Post-Listing Promotion: Continue promoting your token after the listing to sustain interest, encourage trading, and attract potential partnerships.

Ensuring Regulatory Compliance and Legal Preparedness

Regulatory compliance is one of the most important factors for getting a token listed on CoinList. Projects must adhere to local and international securities laws, KYC/AML standards, and other financial regulations. Proper legal preparation ensures that the token launch proceeds smoothly without facing delays, fines, or legal obstacles. Working closely with legal advisors and having thorough documentation demonstrates credibility to both the exchange and investors. A well-prepared project can avoid common pitfalls, gain investor confidence, and strengthen its reputation in the blockchain ecosystem, making compliance a non-negotiable step for long-term success.

-

Understanding Local and International Laws: Ensure your token complies with regulations in the jurisdictions where you operate and where investors are located.

-

KYC/AML Procedures: Implement thorough KYC (Know Your Customer) and AML (Anti-Money Laundering) checks to maintain legal integrity.

-

Legal Documentation: Maintain accurate records, legal opinions, and contracts to support transparency and accountability.

-

Audit and Verification: Conduct third-party audits or legal reviews to validate compliance and minimize risks of regulatory challenges.

Post-Listing Strategies for Growth and Adoption

Listing on CoinList is only the first step toward long-term success. Post-listing strategies focus on maintaining liquidity, investor engagement, and project development. Monitoring trading activity, managing liquidity pools, and responding to investor feedback ensures sustained adoption. Expansion to secondary exchanges enhances token visibility and trading opportunities. Continuous communication with the community, providing updates and announcements, reinforces trust and loyalty. Projects that actively implement post-listing strategies not only maintain investor interest but also create opportunities for partnerships and ecosystem growth, ensuring the token remains relevant and competitive.

-

Liquidity Management: Ensure sufficient liquidity on CoinList and secondary exchanges to encourage trading and investor participation.

-

Community Engagement: Maintain active communication with the community to provide updates and foster loyalty.

-

Expansion to Other Platforms: Successful listings can facilitate expansion to additional exchanges, enhancing visibility and adoption.

-

Performance Monitoring: Track trading volume, investor participation, and token circulation to make informed strategic decisions.

Leveraging Partnerships and Industry Networks

Strategic partnerships and industry networking can greatly amplify the reach and credibility of a blockchain project. Collaborating with well-established projects, platforms, or industry advisors can attract investor attention and foster trust. Participation in blockchain conferences, events, and media exposure enhances visibility and positions the project as a serious contender in the market. Building strong investor relations and connecting with advisors provide long-term support and guidance. Leveraging partnerships and networks strengthens the project’s reputation and creates opportunities for collaboration, adoption, and strategic growth within the cryptocurrency ecosystem.

-

Collaborate with Established Projects: Partnering with well-known projects or platforms can attract attention and investor interest.

-

Industry Events and Conferences: Participating in blockchain events increases visibility and positions your project as a credible contender in the market.

-

Investor Relations: Building strong relationships with investors and advisors helps sustain trust and long-term engagement.

-

Media Exposure: Press releases, interviews, and publications can amplify project awareness and attract more participants to your token sale.

Conclusion

Successfully listing a token on CoinList in 2025 requires careful preparation, regulatory compliance, strategic marketing, and strong community engagement. Partnering with a trusted cryptocurrency exchange listing company ensures a smoother process and provides expert guidance on technical, legal, and promotional aspects. Post-listing strategies, including liquidity management, investor communication, and expansion to other exchanges, are essential to sustain adoption and long-term growth. By following these steps and leveraging strategic partnerships, projects can maximize the impact of their CoinList listing, ensuring credibility, visibility, and ongoing success in the cryptocurrency market.

Leave a Comment