In today’s digital age, trust, accuracy, and compliance have become cornerstones of business success. Whether a company operates in telecom, finance, insurance, or e-commerce, verifying transactions and customer data is no longer optional — it’s essential. That’s where third party verification services (TPV) come in.

A third party verification company acts as an independent authority that validates business transactions, customer consent, and contractual agreements. This unbiased verification ensures transparency, reduces disputes, and protects both businesses and consumers from potential fraud.

As industries evolve with tighter compliance laws and digital onboarding, TPV services are now an indispensable part of secure business operations. Let’s explore how these services work, their benefits, and why partnering with trusted third party verification companies can help your business build credibility and reduce risk.

What Are Third Party Verification Services?

Third party verification (TPV) is a process where an independent organization confirms the accuracy of a transaction or customer authorization. It serves as an impartial audit system that validates details such as identity, consent, and purchase confirmation.

Key Functions of TPV Include:

-

Verifying customer authorizations during sales calls or sign-ups

-

Confirming service changes or plan upgrades

-

Recording verbal or digital consent for contracts

-

Ensuring compliance with regulatory requirements

-

Providing verifiable audit trails for legal protection

By involving a neutral third party, TPV eliminates bias, ensures authenticity, and maintains a secure record of every verified interaction.

Why Businesses Need Third Party Verification Services

In competitive industries, even a small compliance error can lead to heavy penalties or customer distrust. Third party verification services help businesses avoid these pitfalls while enhancing operational efficiency.

1. Compliance Assurance

Regulatory bodies often require verified consent for transactions, especially in telecom, insurance, and utilities. TPV ensures that all customer approvals are documented and compliant with laws.

2. Fraud Prevention

With rising cases of identity theft and misrepresentation, third party verification adds a layer of protection by confirming the authenticity of every transaction.

3. Dispute Reduction

Having recorded verification reduces the likelihood of disputes between customers and companies, saving time and resources in conflict resolution.

4. Quality Control

Verification calls and records help businesses monitor agent performance, ensuring that all sales are ethical, accurate, and transparent.

5. Enhanced Customer Trust

When customers know their transactions are verified by an independent third party, they gain confidence in your brand’s integrity.

Industries That Rely on TPV Companies

Several industries depend heavily on third party verification companies for compliance, efficiency, and fraud prevention.

| Industry | Use of TPV Services |

|---|---|

| Telecom | Confirming customer consent for plan changes, new subscriptions, or number portability. |

| Finance & Banking | Validating loan applications, KYC data, and payment authorizations. |

| Insurance | Verifying policy enrollments, renewals, and premium confirmations. |

| Energy & Utilities | Confirming utility service requests and billing authorizations. |

| E-commerce | Ensuring legitimate orders and preventing chargeback fraud. |

| Healthcare | Verifying patient consent and insurance coverage details. |

Each industry benefits from TPV’s ability to safeguard data and ensure compliance with global and regional regulations.

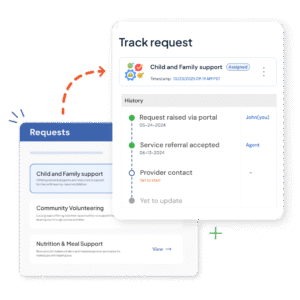

How Third Party Verification Works

The process of third party verification typically follows a structured workflow:

1. Transaction Initiation

A customer agrees to purchase a product or service, often through a sales representative or digital platform.

2. Data Capture

All relevant information — name, contact details, transaction details, etc. — is collected and securely stored.

3. Independent Verification

A third party verification company contacts the customer (via phone, SMS, or email) to confirm their consent and verify details.

4. Recording and Storage

The verification process is recorded for compliance and auditing purposes.

5. Delivery of Verification Report

A final report or audio file is provided to the business as proof of transaction authenticity.

This simple yet effective process strengthens business credibility and ensures regulatory protection.

Benefits of Outsourcing to Third Party Verification Companies

Outsourcing TPV to specialized providers allows businesses to focus on their core operations while experts handle compliance and verification.

1. Cost-Effectiveness

Setting up an in-house TPV system can be expensive. Outsourcing saves infrastructure, hiring, and training costs.

2. Expertise

TPV companies employ trained professionals familiar with regulatory frameworks and verification best practices.

3. Scalability

As your business grows, TPV providers can scale operations to handle high transaction volumes efficiently.

4. Neutrality

An independent third party eliminates any internal bias, ensuring trust and fairness in verification.

5. Technology Integration

Top providers use AI-driven voice analytics, CRM integration, and automated dashboards to enhance accuracy and speed.

6. Round-the-Clock Availability

With 24/7 verification capabilities, your customers can complete transactions anytime, improving overall satisfaction.

Technology Powering Modern TPV Services

Advanced technology has revolutionized how third party verification companies operate. These innovations ensure faster, more accurate, and compliant verifications.

AI Voice Analytics

AI algorithms can detect tone, hesitation, and potential fraud indicators in voice calls.

Automated Call Recording

Every verification call is recorded and securely archived for legal protection.

CRM Integration

TPV systems seamlessly integrate with business CRMs, allowing real-time data access and verification tracking.

Cloud-Based Platforms

Cloud technology ensures scalability, data redundancy, and global access.

Speech-to-Text Conversion

Automated transcription allows easy retrieval and review of verification records.

By leveraging these technologies, third party verification providers ensure efficiency, accuracy, and compliance.

Choosing the Right Third Party Verification Company

Selecting a trustworthy TPV partner is crucial for long-term business success. Here are key factors to consider:

1. Experience and Industry Expertise

Choose a provider with proven experience in your industry — whether it’s telecom, finance, or e-commerce.

2. Compliance Standards

Ensure the company follows global data protection laws like GDPR, HIPAA, and PCI-DSS.

3. Security Infrastructure

Look for providers offering encryption, secure cloud storage, and controlled access protocols.

4. Scalability and Flexibility

Your TPV partner should handle volume spikes and offer multilingual support for international customers.

5. Reporting and Analytics

Comprehensive reporting tools are essential for monitoring verification performance and compliance audits.

6. Transparent Pricing

Opt for providers with clear pricing models and customizable service plans.

Why Outsource TPV Services to India

India has become a global hub for outsourcing third party verification services thanks to its skilled workforce, cost efficiency, and robust technology infrastructure.

Benefits of Outsourcing to Indian TPV Companies:

-

Lower Operational Costs: Competitive pricing without compromising quality.

-

Skilled Talent Pool: English-proficient professionals trained in compliance.

-

Advanced Technology: AI, IVR, and cloud-based verification systems.

-

24/7 Operations: Support across multiple time zones.

-

Data Security: Adherence to ISO and GDPR standards.

Many global enterprises trust Indian TPV providers to handle millions of verifications every month efficiently.

Common Challenges in Third Party Verification — and How to Overcome Them

Even with advanced systems, businesses may face challenges when managing TPV processes.

1. Data Security Risks

Ensure your provider follows encryption standards and secure APIs to protect sensitive customer data.

2. Compliance Complexity

Stay updated with changing regulations; reliable TPV partners help ensure ongoing compliance.

3. Delayed Verifications

Use automated workflows and AI tools to streamline verification speed.

4. Customer Communication Issues

Provide clear instructions to customers during verification to avoid confusion or drop-offs.

The Future of Third Party Verification Services

The future of TPV is driven by automation, AI, and blockchain technology. Smart verification systems will soon authenticate transactions instantly while maintaining complete transparency.

Emerging Trends Include:

-

AI-powered Fraud Detection: Predict and prevent fraudulent transactions.

-

Blockchain-based Verification: Immutable verification records for maximum trust.

-

Omnichannel Verification: Seamless verification across voice, web, and mobile apps.

-

Predictive Compliance Analytics: AI tools monitoring regulatory trends to maintain compliance.

These innovations promise to make third party verification faster, safer, and more customer-centric than ever before.

Conclusion

In an era where trust defines brand reputation, third party verification services have become essential for every business handling customer data or digital transactions.

Partnering with professional third party verification companies ensures accuracy, transparency, and compliance — while protecting both you and your customers from risk.

Outsourcing TPV not only minimizes operational burdens but also strengthens credibility, customer satisfaction, and regulatory confidence. Whether you operate in telecom, finance, or e-commerce, investing in third party verification is not just a security measure — it’s a strategic business decision that builds long-term trust.