Introduction

Your home is more than just a place to live it’s a valuable financial asset. For homeowners in Austin, Texas, understanding home equity can open doors to smart financial opportunities. Whether you’re planning to renovate, consolidate debt, or fund major life goals, leveraging your home equity effectively can give you the financial freedom you deserve.

Understanding Home Equity and Its Importance

In simple terms, Home Equity is the portion of your home that you truly own. It’s the difference between your home’s market value and the balance on your mortgage. The more you pay toward your mortgage, the more equity you build over time.

Your equity can serve as a foundation for achieving long term goals. Many homeowners in Austin use home equity to finance higher education, launch new businesses, or invest in property improvements. With the right mortgage lenders, you can turn your equity into accessible funds while keeping your financial stability intact.

How Home Equity Works

Every mortgage payment increases your ownership share of your home. When the property value rises, your equity also grows. This natural growth can lead to substantial financial power when managed strategically.

Here’s how you can build equity faster:

-

Make extra mortgage payments whenever possible.

-

Choose shorter loan terms to reduce interest costs.

-

Increase your home’s market value through upgrades.

-

Monitor your property’s appreciation in the Austin housing market.

By combining these efforts, you can accelerate your equity growth and enhance your borrowing potential.

The Benefits of Home Equity for Austin Homeowners

Using home equity offers multiple advantages for residents of Austin, Texas. Beyond simple borrowing, it’s a flexible financial tool that can help manage various personal and financial needs.

Key benefits include:

-

Lower Interest Rates: Home equity loans often offer better rates compared to credit cards or unsecured loans.

-

Tax Advantages: In some cases, the interest paid on home equity loans may be tax deductible.

-

Financial Flexibility: Use your funds for home renovations, college tuition, or major purchases.

-

Increased Property Value: Investing back into your home can further boost your overall equity.

With the help of reputable mortgage lenders, you can access competitive rates and personalized options to make your equity work for you.

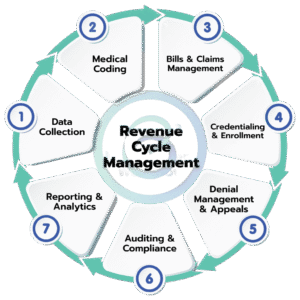

Exploring the Main Types of Home Equity Loans

There are different ways to tap into your home equity, each designed to fit specific needs. Understanding these options helps you choose the best path for your financial goals.

-

Home Equity Loan (HEL):

A fixed rate loan that provides a lump sum upfront. Ideal for one time expenses like remodeling or debt consolidation. -

Home Equity Line of Credit (HELOC):

Works like a credit card, allowing you to withdraw funds as needed during a draw period. This option offers flexibility for ongoing expenses. -

Cash Out Refinance:

Replace your current mortgage with a new one for a higher amount and receive the difference in cash. Perfect for homeowners seeking larger funds at once.

Each option carries its own advantages and considerations. Working with expert mortgage lenders in Austin ensures you select a loan structure aligned with your income, goals, and repayment capacity.

Why Austin Homeowners Are Leveraging Home Equity

Austin’s real estate market continues to thrive, with rising property values benefiting local homeowners. Increased home appreciation means more potential equity. Residents are capitalizing on this opportunity to access funds for renovations, investments, or emergency reserves.

Local Mortgage Lenders in Austin have tailored programs for different needs, whether it’s a growing family expanding their living space or an entrepreneur seeking startup capital. With expert guidance, using home equity becomes a powerful financial strategy rather than a risky decision.

How to Calculate Your Home Equity

Knowing your current home equity gives you a clear picture of your borrowing potential. The formula is simple:

Home Equity = Current Market Value of Home Outstanding Mortgage Balance

For example, if your Austin home is valued at $600,000 and your remaining mortgage is $350,000, your equity stands at $250,000. This amount can then be used to determine how much you can borrow through a loan or line of credit.

Choosing the Right Mortgage Lenders in Austin

Selecting the right mortgage lenders is crucial when dealing with home equity. A reliable lender not only offers favorable rates but also ensures a transparent process from start to finish.

When comparing lenders in Austin, consider these factors:

-

Interest Rates: Compare both fixed and variable options.

-

Loan Terms: Choose repayment schedules that fit your income stability.

-

Customer Support: Look for lenders who provide guidance and clarity.

-

Local Expertise: Austin based lenders understand the city’s housing trends and can provide personalized solutions.

Working with trusted professionals helps you make confident financial decisions while avoiding unnecessary fees or risks.

Smart Ways to Use Your Home Equity Funds

Once you’ve unlocked your home equity, the possibilities are vast. However, using it wisely ensures long-term benefits rather than short term gains.

Here are some strategic uses for your funds:

-

Home Renovations: Increase property value and comfort.

-

Debt Consolidation: Pay off high interest debts with a lower rate loan.

-

Emergency Fund: Maintain financial security during tough times.

-

Education Costs: Support higher education for yourself or your family.

-

Investment Opportunities: Fund new ventures or purchase investment property.

Responsible use of equity ensures your home remains both a valuable asset and a source of financial growth.

Common Mistakes to Avoid When Using Home Equity

While home equity offers significant advantages, mismanagement can lead to financial strain. Avoiding common pitfalls can protect your investment and credit health.

Key mistakes to watch for include:

-

Borrowing more than you can repay.

-

Ignoring changes in property values or interest rates.

-

Using funds for non essential purchases.

-

Failing to review loan terms carefully.

By staying informed and working with expert mortgage lenders, Austin homeowners can maximize benefits while minimizing risks.

The Role of Professional Mortgage Guidance

Navigating home equity decisions can be complex. That’s where professional guidance makes a difference. Local mortgage experts understand Austin’s dynamic housing market and can help you identify opportunities that align with your goals.

At Big Brother Mortgage, our experienced team focuses on helping Austin residents use their home equity effectively. From detailed consultations to personalized loan solutions, we aim to simplify the process and secure your financial confidence.

Final Thoughts: Empowering Your Future with Home Equity

Your home is more than shelter it’s a strategic asset that can strengthen your financial future. By understanding how home equity works and partnering with trusted mortgage lenders, you can turn your property into a source of opportunity. Whether you’re renovating your Austin home, paying off debt, or planning for your next milestone, your equity can unlock lasting stability and growth.

So, are you ready to make your home equity work for your future?

Frequently Asked Questions (FAQs)

1. What is home equity and how is it calculated?

Home equity is the difference between your home’s market value and the amount you owe on your mortgage. It grows as you pay down your loan or your property value increases.

2. How can I use my home equity?

You can use your equity for home improvements, debt consolidation, education expenses, or major financial investments.

3. What are the benefits of home equity loans?

Home equity loans offer lower interest rates, potential tax deductions, and the ability to access significant funds while maintaining homeownership.

4. How do I choose the best mortgage lenders in Austin?

Compare interest rates, customer service, loan terms, and local expertise. Choose lenders that understand Austin’s housing market and offer flexible options.

5. Is it risky to use home equity?

It can be if not managed properly. Borrow responsibly, understand repayment terms, and work with experienced mortgage professionals to ensure your financial safety.