How Is Bitcoin Changing the Future of Automatic Payments?

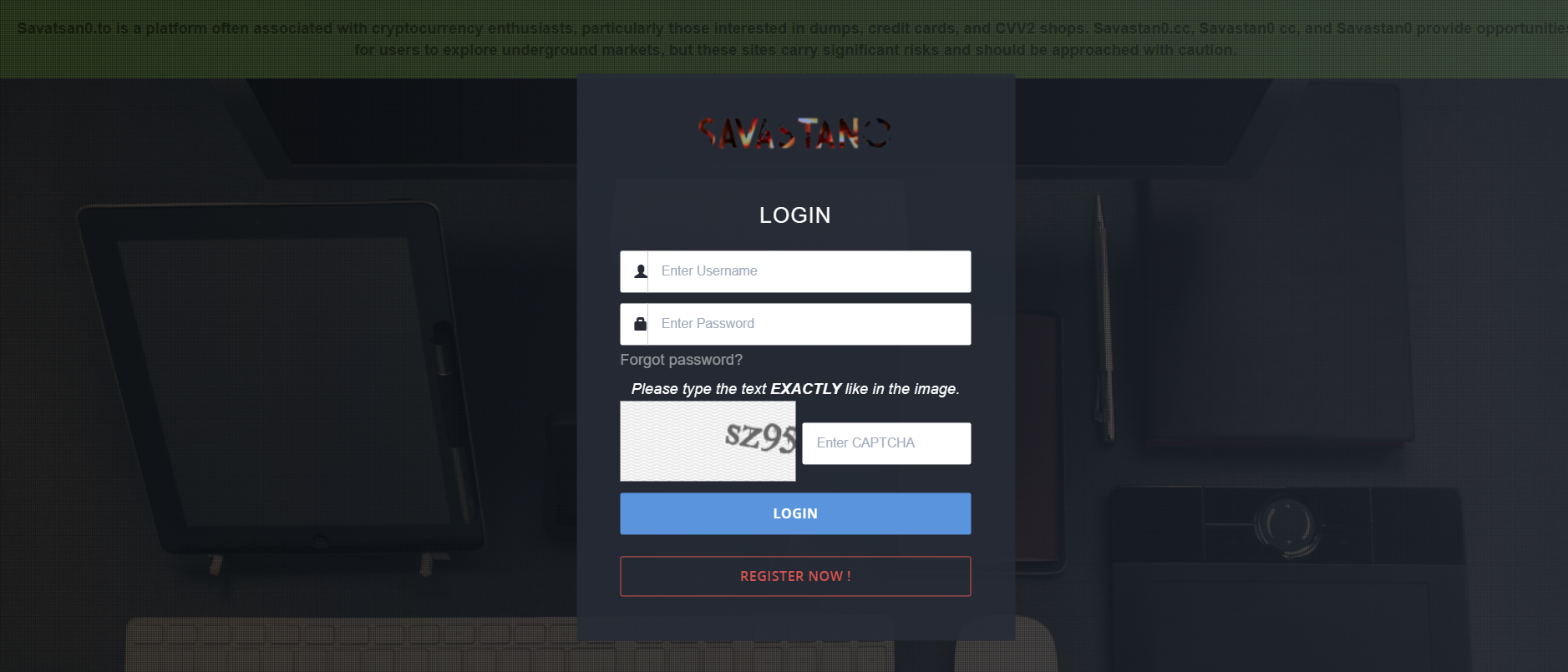

Bitcoin has revolutionized the financial landscape over the past decade, changing how we perceive and handle transactions in a digital world. As one of the most well-known cryptocurrencies, Bitcoin is creating a buzz in many industries, particularly in automatic payment systems. The rise of platforms like “Savastan0” in the cryptocurrency payment arena has fueled discussions about the future of digital transactions, bringing convenience, security, and innovation to businesses and individuals alike.

In this post, we will explore how Bitcoin is transforming automatic payment systems and the potential it holds for the future of seamless transactions. This discussion highlights key trends, benefits, and challenges of incorporating Bitcoin into automated payment solutions, while also addressing why its unique features make it an attractive option for digital commerce.

The Rise of Bitcoin in Payment Systems

Bitcoin was initially developed as a decentralized digital currency aimed at reducing reliance on centralized banks and financial institutions. With no need for a middleman, Bitcoin transactions occur directly between two parties, making them faster and more secure than traditional payment methods. This decentralized nature, coupled with its underlying blockchain technology, has laid the groundwork for Bitcoin to make significant strides in payment systems.

In recent years, Bitcoin has increasingly been used for automatic payment systems, particularly for recurring payments such as subscriptions, utilities, and e-commerce transactions. Automatic payments are crucial for businesses that deal with repetitive transactions, and Bitcoin’s ability to process payments without geographical or banking restrictions opens new doors for companies to operate on a global scale.

How Bitcoin Enables Automatic Payments

Traditional automatic payment systems rely on financial institutions to process transactions at scheduled intervals. This often includes a network of banks, credit card companies, and other intermediaries, which can introduce delays, fees, and potential security risks. Bitcoin offers a streamlined alternative, where payments can be scheduled and executed without the need for third-party involvement.

The process of setting up automatic payments with Bitcoin involves using smart contracts or APIs that enable recurring transactions. Smart contracts are self-executing agreements encoded on the blockchain, which automatically carry out the terms of a contract once predefined conditions are met. For example, a user can set up a smart contract that sends a specific amount of Bitcoin to a service provider on a set date every month. This process eliminates the need for manual approval and reduces human error, making it an ideal solution for automatic payments.

APIs, on the other hand, allow for the integration of Bitcoin into existing payment platforms. Businesses can use APIs to schedule Bitcoin transactions automatically, enabling them to accept payments without manual input. This is particularly useful for businesses that want to integrate Bitcoin payments into their e-commerce sites, mobile apps, or subscription services.

Benefits of Using Bitcoin for Automatic Payments

- Lower Transaction Fees: Bitcoin transactions typically have lower fees than traditional payment methods, especially when dealing with cross-border payments. This cost-saving benefit makes it an attractive option for businesses that handle large volumes of transactions or operate in multiple countries.

- Faster Processing Times: Bitcoin transactions can be processed within minutes, depending on network congestion, whereas traditional payment systems may take days to settle. This speed allows businesses to receive payments more quickly, improving cash flow and reducing delays.

- Enhanced Security: Bitcoin’s underlying blockchain technology provides a high level of security. Every transaction is recorded on a public ledger, which makes it nearly impossible to alter or tamper with. This transparency reduces the risk of fraud, making Bitcoin an appealing choice for businesses concerned about security in payment processing.

- Global Accessibility: Bitcoin is not restricted by borders or local banking regulations, making it accessible to anyone with an internet connection. This global reach enables businesses to expand their customer base without worrying about exchange rates, international banking fees, or the availability of local payment processors.

- No Chargebacks: Unlike credit card transactions, Bitcoin payments are irreversible once confirmed. This eliminates the risk of chargebacks, which can be a headache for businesses that frequently deal with fraudulent claims or payment disputes.

- Increased Transparency: Because Bitcoin transactions are recorded on a public ledger, businesses and customers can easily track and verify payments. This level of transparency fosters trust between parties and can help resolve disputes more effectively.

Challenges of Using Bitcoin for Automatic Payments

While Bitcoin presents several advantages for automatic payments, it also has its challenges. Businesses must carefully weigh the following factors before fully committing to Bitcoin-based automatic payments.

- Volatility: One of the most significant drawbacks of using Bitcoin for payments is its price volatility. Bitcoin’s value can fluctuate dramatically in a short period, which could lead to businesses receiving less value than expected for their products or services. Solutions like stablecoins, which are cryptocurrencies pegged to a stable asset like the US dollar, can help mitigate this risk.

- Complexity: Setting up Bitcoin automatic payments requires some technical expertise, particularly if businesses choose to integrate smart contracts or APIs. This can be a barrier for small businesses or individuals who lack the resources to implement and maintain such systems.

- Regulatory Uncertainty: The legal and regulatory landscape surrounding Bitcoin and cryptocurrencies is still evolving. Some countries have embraced Bitcoin, while others have imposed restrictions or outright bans. This uncertainty can make it difficult for businesses to navigate the legal implications of accepting Bitcoin for automatic payments, particularly on a global scale.

- Scalability Issues: Bitcoin’s blockchain can sometimes experience congestion, leading to slower transaction times and higher fees. While Bitcoin’s Lightning Network aims to address scalability issues by enabling faster, lower-cost transactions, it is still in the early stages of adoption.

The Future of Bitcoin in Automatic Payments

Despite the challenges, Bitcoin has enormous potential to revolutionize the future of automatic payments. As blockchain technology continues to advance, we are likely to see more user-friendly solutions emerge, making it easier for businesses and individuals to adopt Bitcoin for automatic payments.

One such development is the growing adoption of Lightning Network, a layer-2 solution that sits on top of the Bitcoin blockchain. The Lightning Network allows for faster and cheaper transactions by enabling off-chain payments, which are settled on the blockchain at a later time. This innovation could help alleviate some of the scalability issues that have plagued Bitcoin in recent years, making it a more viable option for businesses that require high transaction throughput.

Additionally, with the increasing popularity of decentralized finance (DeFi) applications, Bitcoin is poised to play a central role in a future where financial services are decentralized and automated. DeFi platforms, which operate without traditional financial intermediaries, can leverage Bitcoin for lending, borrowing, and other financial services, further integrating Bitcoin into the fabric of automated payments.

Conclusion

Bitcoin’s integration into automatic payment systems represents a significant shift in how businesses and consumers conduct transactions. Its ability to provide lower fees, faster processing times, and enhanced security makes it an attractive alternative to traditional payment methods. While challenges such as volatility and regulatory uncertainty remain, the potential for Bitcoin to transform the future of payments cannot be ignored.

As technologies like smart contracts and the Lightning Network continue to develop, Bitcoin’s role in automatic payments will likely expand, bringing with it new opportunities for innovation and growth in the digital economy. The use of Bitcoin in automated payments may very well become a standard practice in the future, empowering businesses to operate more efficiently and securely in an increasingly digital world.

Leave a Comment