How Outsourcing Accounts Payable Can Free Up Your Team’s Time

In today’s fast-paced business environment, efficiency is key. One area where many companies struggle is in managing their accounts payable (AP) processes. As organizations grow, so do their financial obligations, which can lead to overwhelmed teams and delayed payments. One solution that has gained traction is outsourcing accounts payable. In this blog, we will explore how outsourcing AP can free up your team’s time and enhance overall productivity.

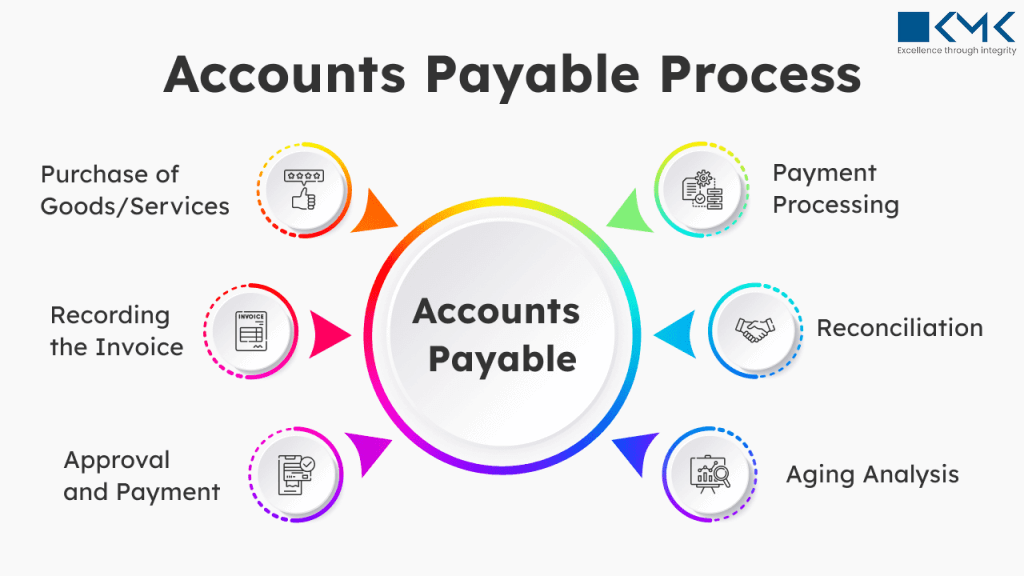

Understanding Accounts Payable

Accounts payable refers to the money that a company owes to its suppliers for goods or services received. Effective management of this process is crucial for maintaining healthy supplier relationships and ensuring smooth operations. However, handling AP involves various tasks such as invoice processing, data entry, approvals, and payment processing. These tasks can consume significant time and resources if managed in-house.

The Burden of In-House AP Management

When companies manage accounts payable internally, they often face several challenges:

- Manual Processes: Many organizations rely on manual data entry, which can lead to errors and inefficiencies. This not only wastes time but can also result in costly mistakes.

- High Workload: As businesses expand, the volume of invoices and payments increases. This can overwhelm finance teams, leading to burnout and decreased productivity.

- Limited Focus on Strategy: When teams are bogged down with repetitive tasks, they have less time to focus on strategic initiatives that could drive growth.

- Compliance Risks: Managing AP in-house can also lead to compliance challenges, as regulations and reporting requirements can be complex and constantly changing.

The Benefits of Outsourcing Accounts Payable

Outsourcing accounts payable can alleviate these burdens and provide numerous advantages:

1. Increased Efficiency

By outsourcing AP, businesses can streamline their processes. Third-party providers specialize in financial operations, utilizing advanced technology to automate tasks. This minimizes manual data entry and accelerates invoice processing, allowing your team to focus on higher-value activities.

2. Cost Savings

While there is a cost associated with outsourcing, the savings can be substantial. By reducing the need for in-house staff, training, and software, companies can allocate resources more effectively. Additionally, outsourcing firms often have established relationships with suppliers, which may lead to discounts or improved payment terms.

3. Access to Expertise

Outsourcing AP provides access to a team of experts who are well-versed in financial regulations and best practices. This expertise can help mitigate compliance risks and ensure that your organization stays updated with industry standards.

4. Scalability

As your business grows, so will your accounts payable needs. Outsourcing allows for scalability; you can easily adjust the level of service based on your current requirements without the hassle of hiring or training new staff.

5. Enhanced Cash Flow Management

With a streamlined AP process, businesses can improve their cash flow management. Timely payments can lead to better relationships with suppliers, potential discounts, and increased negotiation power in future contracts.

6. Improved Focus

When your finance team is relieved of routine AP tasks, they can shift their focus to strategic planning, financial analysis, and other critical areas that contribute to growth. This shift can enhance overall business performance.

Implementing an Outsourced AP Solution

Transitioning to an outsourced accounts payable solution requires careful planning. Here are some steps to ensure a smooth transition:

1. Evaluate Your Needs

Before outsourcing, assess your current AP processes. Identify bottlenecks and understand the volume of work involved. This evaluation will help you determine the level of service you require.

2. Choose the Right Partner

Research potential outsourcing partners thoroughly. Look for firms with a proven track record, positive client reviews, and expertise in your industry. Ensure they use secure technology and can integrate seamlessly with your existing systems.

3. Define Clear Processes

Collaborate with your outsourcing partner to establish clear processes and expectations. Define roles, responsibilities, and communication protocols to ensure a smooth workflow.

4. Monitor Performance

Once the outsourcing arrangement is in place, regularly monitor performance metrics. This will help you assess the efficiency of the outsourced AP function and make adjustments as needed.

Conclusion

Outsourcing accounts payable is a strategic move that can significantly free up your team’s time and enhance overall productivity. By alleviating the burdens of manual processes, compliance risks, and increasing workloads, your finance team can focus on what truly matters: driving business growth and innovation. As companies continue to seek ways to optimize operations, outsourcing AP stands out as a viable solution for achieving efficiency and success in today’s competitive landscape.

![K-12 Online Education Market Size & Industry Analysis [2033] Market Growth Reports](https://easybacklinkseo.com/wp-content/uploads/2025/08/MGR_UST041-510x369.jpeg)

Leave a Comment