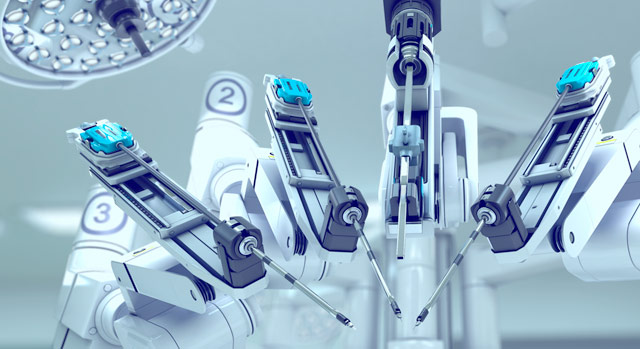

Surgical Robots Market Size, Share, Trends, Report 2032

The global surgical robots market has been witnessing remarkable growth, driven primarily by the increasing demand for minimally invasive surgeries worldwide. Valued at USD 7.40 billion in 2023, the market is poised for substantial expansion, with projections indicating a Compound Annual Growth Rate (CAGR) of 15.7% from 2024 to 2032. By the end of the forecast period, the market is expected to reach an impressive USD 27.51 billion. This growth is fueled by advancements in robotic technology, rising prevalence of chronic diseases, and the growing preference for outpatient surgical procedures. In this comprehensive analysis, we will delve into the factors driving this growth and explore the key players shaping the industry, including Intuitive Surgical Inc, Stryker, Johnson & Johnson Services, Inc., and Medtronic.

Market Overview

Current Market Valuation

In 2023, the global surgical robots market was valued at USD 7.40 billion. This valuation reflects the substantial investments in robotic technologies and the increasing adoption of these systems in various surgical procedures. The integration of robotics in surgery has revolutionized the healthcare sector by enhancing precision, reducing invasiveness, and improving patient outcomes.

Growth Projections

The market is projected to grow at a CAGR of 15.7% from 2024 to 2032, reaching a value of USD 27.51 billion by 2032. This robust growth trajectory underscores the transformative impact of surgical robotics on modern medicine. Several factors contribute to this optimistic outlook:

- Technological Advancements: Continuous innovations in robotics, artificial intelligence (AI), and machine learning (ML) are enhancing the capabilities of surgical robots, making them more versatile and efficient.

- Minimally Invasive Surgeries: There is a growing preference for minimally invasive procedures due to their benefits, including shorter recovery times, reduced pain, and minimal scarring. Surgical robots play a crucial role in facilitating these procedures.

- Aging Population: An increasing elderly population worldwide is leading to a higher incidence of chronic diseases and conditions that require surgical interventions, thereby driving the demand for advanced surgical technologies.

- Healthcare Infrastructure: Improvements in healthcare infrastructure, particularly in developing regions, are expanding access to advanced surgical care, boosting the adoption of robotic systems.

- Cost Reduction: As the technology matures, the cost of surgical robots is decreasing, making them more accessible to a broader range of healthcare providers.

Get a Free Sample Report with Table of Contents

Regional Insights

North America currently dominates the surgical robots market, driven by the presence of major market players, advanced healthcare infrastructure, and high adoption rates of innovative technologies. However, Asia-Pacific is expected to witness the highest growth rate during the forecast period, fueled by rapid economic development, increasing healthcare expenditure, and a growing emphasis on advanced medical technologies.

Key Market Players

The surgical robots market is highly competitive, with several key players leading the charge in innovation and market penetration. Among these, Intuitive Surgical Inc, Stryker, Johnson & Johnson Services, Inc., and Medtronic stand out as prominent leaders. Each of these companies has carved a niche through unique product offerings, strategic acquisitions, and a commitment to advancing surgical robotics technology.

Intuitive Surgical Inc

Overview

Intuitive Surgical Inc is a pioneer in the surgical robotics industry, best known for its da Vinci Surgical System. Founded in 1995 and headquartered in Sunnyvale, California, Intuitive Surgical has established itself as a market leader through continuous innovation and a strong focus on minimally invasive surgical solutions.

Product Portfolio

- da Vinci Surgical System: The flagship product, da Vinci, is designed to facilitate complex surgeries with enhanced precision, flexibility, and control. It enables surgeons to perform minimally invasive procedures across various specialties, including urology, gynecology, and general surgery.

- S-Systems: These are specialized versions of the da Vinci system tailored for specific surgical applications, such as the da Vinci Xi for advanced multi-quadrant procedures and the da Vinci SP for single-port surgeries.

Technological Innovations

Intuitive Surgical invests heavily in research and development to stay at the forefront of surgical robotics. Recent advancements include:

- Enhanced Visualization: Improved 3D imaging and augmented reality capabilities provide surgeons with better visibility and spatial awareness during procedures.

- AI Integration: Incorporating AI to assist in surgical planning, real-time decision-making, and predictive analytics to enhance surgical outcomes.

- Robotic Autonomy: Developing semi-autonomous functions to reduce surgeon fatigue and improve precision in repetitive tasks.

Market Strategy

Intuitive Surgical employs a robust market strategy that includes:

- Global Expansion: Expanding its presence in emerging markets through strategic partnerships and local manufacturing facilities.

- Training and Support: Offering comprehensive training programs and support services to ensure optimal utilization of their robotic systems.

- Customer-Centric Approach: Focusing on customer feedback to drive product improvements and tailor solutions to meet specific surgical needs.

Stryker

Overview

Stryker is a diversified medical technology company headquartered in Kalamazoo, Michigan. With a strong presence in various segments, including surgical equipment, neurotechnology, and spine, Stryker has made significant inroads into the surgical robotics market through strategic acquisitions and innovative product development.

Product Portfolio

- MAKO Surgical Robots: Acquired by Stryker in 2013, the MAKO system specializes in orthopedic surgeries, particularly in joint replacement procedures such as knee and hip replacements. The system uses robotic arm-assisted technology to enhance surgical precision and outcomes.

- Stryker’s Robotic Systems: In addition to MAKO, Stryker is developing and expanding its range of robotic systems for different surgical applications, including spine and trauma surgeries.

Technological Innovations

Stryker focuses on integrating advanced technologies to enhance the functionality and efficiency of its robotic systems:

- Preoperative Planning: Utilizing 3D imaging and virtual planning tools to enable surgeons to plan procedures with high accuracy.

- Intraoperative Navigation: Real-time tracking and guidance during surgeries to ensure precise implant placement and minimize errors.

- Data Analytics: Leveraging data from surgical procedures to improve system performance and patient outcomes through continuous learning and optimization.

Market Strategy

Stryker’s approach to capturing market share in the surgical robotics arena includes:

- Strategic Acquisitions: Acquiring innovative companies like MAKO to diversify its product offerings and enter new surgical domains.

- Collaborations and Partnerships: Partnering with leading healthcare institutions and research organizations to drive innovation and validate the efficacy of its robotic systems.

- Focus on Orthopedics: Capitalizing on the growing demand for joint replacement surgeries by providing specialized robotic solutions that enhance surgical precision and patient satisfaction.

Johnson & Johnson Services, Inc.

Overview

Johnson & Johnson Services, Inc., a subsidiary of Johnson & Johnson, is a global leader in medical devices, pharmaceuticals, and consumer health products. Through its subsidiary Ethicon, J&J has ventured into the surgical robotics market, focusing on innovative solutions that improve surgical outcomes and enhance patient care.

Product Portfolio

- Verb Surgical: A collaboration between Johnson & Johnson and Verily (Alphabet’s life sciences division), Verb Surgical aims to develop a comprehensive surgical robotics platform that integrates robotics, data analytics, and visualization technologies.

- Existing Surgical Instruments: While still expanding its robotics portfolio, J&J continues to offer a wide range of surgical instruments and devices that complement its robotic systems.

Technological Innovations

Johnson & Johnson emphasizes integrating cutting-edge technologies to advance surgical robotics:

- Data-Driven Surgery: Utilizing data analytics and AI to provide surgeons with real-time insights and predictive analytics for better decision-making during procedures.

- Enhanced User Interface: Developing intuitive user interfaces and ergonomic designs to improve surgeon comfort and reduce fatigue during lengthy surgeries.

- Modular Systems: Creating modular robotic systems that can be easily adapted or upgraded to meet evolving surgical needs and technological advancements.

Market Strategy

J&J’s strategy in the surgical robotics market includes:

- Collaborative Innovation: Partnering with technology companies and research institutions to co-develop advanced robotic solutions.

- Comprehensive Training Programs: Offering extensive training and certification programs to ensure surgeons are proficient in using their robotic systems.

- Focus on Integration: Ensuring seamless integration of robotic systems with existing hospital infrastructure and electronic medical records (EMR) for streamlined workflows.

Medtronic

Overview

Medtronic, headquartered in Dublin, Ireland, is one of the world’s largest medical technology companies. With a diverse portfolio spanning various medical fields, Medtronic has been actively expanding its footprint in the surgical robotics market through innovation and strategic acquisitions.

Product Portfolio

- StealthStation: While primarily known for navigation systems, Medtronic has been developing robotic-assisted technologies to complement its existing offerings in neurosurgery and spine surgery.

- Minimally Invasive Surgical Robots: Medtronic is investing in the development of robotic systems that facilitate minimally invasive procedures across different surgical specialties.

Technological Innovations

Medtronic focuses on integrating robotics with its extensive experience in medical devices to enhance surgical capabilities:

- Advanced Imaging: Incorporating high-resolution imaging and real-time data integration to assist surgeons in navigating complex anatomical structures.

- Automation and Precision: Developing robotic systems that offer enhanced precision and control, reducing the likelihood of human error and improving surgical outcomes.

- Interoperability: Ensuring that Medtronic’s robotic systems are compatible with other medical devices and hospital information systems for a cohesive surgical environment.

Market Strategy

Medtronic’s approach to the surgical robotics market involves:

- Research and Development: Investing significantly in R&D to pioneer new robotic technologies and expand the capabilities of existing systems.

- Global Reach: Leveraging its extensive global distribution network to market and support its robotic systems in diverse regions.

- Customer Support and Service: Providing comprehensive support services, including maintenance, training, and technical assistance to ensure optimal performance of their robotic systems.

Drivers of Market Growth

Several key factors are propelling the growth of the surgical robots market:

Increasing Demand for Minimally Invasive Surgeries

Minimally invasive surgeries (MIS) offer numerous benefits over traditional open surgeries, including reduced blood loss, shorter hospital stays, faster recovery times, and minimal scarring. Surgical robots are instrumental in performing MIS with higher precision and control, thereby enhancing patient outcomes and driving the adoption of robotic systems.

Technological Advancements

Continuous advancements in robotics, AI, machine learning, and imaging technologies are expanding the capabilities of surgical robots. Innovations such as enhanced 3D visualization, real-time data analytics, and autonomous functionalities are making surgical procedures safer and more efficient.

Rising Prevalence of Chronic Diseases

The increasing incidence of chronic diseases such as cancer, cardiovascular disorders, and musculoskeletal conditions necessitates surgical interventions. Surgical robots offer improved outcomes for patients undergoing procedures for these conditions, thereby fueling market growth.

Aging Population

A global aging population is leading to a higher demand for surgical interventions to address age-related health issues. Older patients often require complex surgeries, which can benefit significantly from the precision and minimally invasive nature of robotic assistance.

Enhanced Healthcare Infrastructure

Improvements in healthcare infrastructure, particularly in developing regions, are facilitating the adoption of advanced surgical technologies. Investments in healthcare facilities, coupled with government initiatives to improve healthcare access, are contributing to the growth of the surgical robots market.

Cost Reduction and Accessibility

As surgical robot technology matures, the cost of these systems is decreasing, making them more accessible to a broader range of healthcare providers. Additionally, financing options and leasing models are making it easier for hospitals and clinics to invest in robotic systems without significant upfront costs.

Challenges and Restraints

Despite the positive growth outlook, the surgical robots market faces several challenges:

High Initial Investment

The high cost of acquiring and maintaining surgical robots can be a barrier for many healthcare providers, particularly in developing regions. The substantial capital investment required may limit the adoption of robotic systems in cost-sensitive markets.

Training and Skill Requirements

Effective utilization of surgical robots requires specialized training and expertise. The lack of trained personnel and the steep learning curve associated with robotic systems can hinder their widespread adoption.

Regulatory Hurdles

Navigating the complex regulatory landscape for medical devices can be challenging. Ensuring compliance with stringent regulations and obtaining necessary approvals can delay the introduction of new robotic systems to the market.

Technical Limitations

While surgical robots offer enhanced precision, they are not without technical limitations. Issues such as system reliability, software glitches, and limited haptic feedback can impact surgical performance and patient outcomes.

Competition and Market Saturation

The surgical robots market is becoming increasingly competitive, with numerous players vying for market share. Intense competition can lead to price wars and reduced profit margins, posing challenges for market players.

Future Outlook

The future of the surgical robots market appears promising, with continued technological advancements and expanding applications across various surgical disciplines. Key trends shaping the future of the market include:

Integration of AI and Machine Learning

The integration of AI and ML into surgical robotics will enhance the capabilities of robotic systems, enabling them to perform more complex tasks, provide real-time decision support, and improve surgical precision.

Expansion into New Surgical Domains

Surgical robots are expected to expand into new surgical domains such as cardiovascular surgery, neurosurgery, and gastroenterology, broadening their application scope and driving market growth.

Enhanced Human-Robot Collaboration

Advancements in human-robot collaboration will lead to more intuitive and seamless interactions between surgeons and robotic systems, enhancing the overall surgical experience and outcomes.

Personalized Surgery

Robotic systems will increasingly incorporate personalized data and patient-specific information to tailor surgical procedures, improving the effectiveness and safety of interventions.

Global Expansion

Emerging markets in Asia-Pacific, Latin America, and the Middle East will witness significant growth in the adoption of surgical robots, driven by improving healthcare infrastructure and rising healthcare expenditures.

Leave a Comment