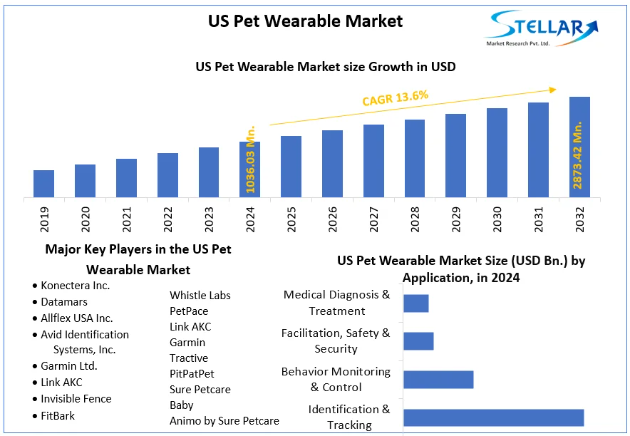

US Pet Wearable Market Size, Top Manufacturers, Forecast2032

US Pet Wearable Market size was valued at USD 1036.03 Mn. in 2024 and the total US Pet Wearable revenue is expected to grow at a CAGR of 13.6% from 2025 to 2032, reaching nearly USD 2873.42 Mn.

Market Estimation & Definition

The US Pet Wearable Market encompasses connected devices like smart collars, harnesses, and vests equipped with technologies—GPS, RFID, biometric sensors—for tracking location, monitoring health, fitness, and behavior. In 2024, the market achieved USD 1.036 billion, and under a projected 13.6% CAGR, it is forecasted to nearly triple in value by 2032

Market Growth Drivers & Opportunities

Heightened Focus on Pet Health & Safety

Pet owners increasingly regard pets as family members, dedicating more resources to their health. Wearables capable of monitoring vital signs, sleep patterns, and activity levels support early detection of health issues—enhancing both preventive care and veterinary diagnosis

Rising Security & Location Tracking Needs

GPS-enabled wearables accounted for roughly 40% of technology adoption in 2024, providing reassurance against lost or wandering pets Advances in real-time tracking and user-friendly interfaces are further fueling uptake.

Pet Humanization & Tech Integration

The trend of treating pets as central family members is driving demand for smart devices, with pet tech companies innovating in real-time monitoring, behavioral insights, and medical-grade analytics. This integration enhances both safety and pet-owner engagement

Surge in Pet Ownership & Spending

Over 65 million US households own dogs, with cat ownership close behind. This pet population, combined with increased disposable income, underpins robust demand for premium pet accessories.

Advancements in Sensor Technology & IoT Platforms

Modern devices incorporate RFID, Bluetooth, GPS, and biometric sensors to deliver sophisticated pet metrics. Data analytics and app-driven insights are creating a new class of smart pet health services.

Vet Telemedicine & Remote Monitoring

Telehealth is gaining traction in veterinary care. Wearables that enable remote monitoring of health metrics are supporting veterinarian consultations in real-time, making pet care more proactive.

Segmentation Analysis

By Technology

-

GPS (~40% share): Leading segment due to strong demand for location tracking

-

RFID: Popular for identification-centric wearables.

-

Sensors: Emerging fast—used for measuring heart rate, activity levels, and behavioral indicators across medical and lifestyle-focused devices

By Product Type

-

Smart Collars: Most prevalent (~45–60% revenue share), combining tracking and health features

-

Smart Vests & Harnesses: Growing in demand for active pets.

-

Smart Cameras & Tags: Emerging but smaller.

By Application

-

Identification & Tracking (~60%): Dominates owing to high demand for pet location safety

-

Fitness & Behavior Monitoring: Gaining interest among health-conscious pet owners.

-

Medical Diagnosis & Treatment: Rapidly expanding niche with vet-grade insights

Country-Level Analysis: United States

Market Size & Forecast

-

2023: USD 912 million

-

2024: USD 1.036 billion

-

2032 Projection: USD 2.873 billion

-

CAGR (2025–2032): 13.6%

Technology Trends

GPS wearables led the market in 2024, reflecting growing concerns about pet safety. RFID and sensor segments continue expanding due to increased interest in health monitoring such as heart rate, temperature, and sleep patterns .

Adoption Landscape

Early adopters are tech-savvy pet owners, while mainstream users are shifting toward health and lifestyle devices. Veterinarians and pet professionals are promoting wearables to support remote health monitoring.

Commutator Analysis (Porter’s Five Forces)

Industry Rivalry – High

The market includes major Tech + Pet brands—Garmin, FitBark, Whistle Labs, PetPace, Link AKC—plus agile startups competing via feature-rich, connected devices .

Threat of New Entrants – Moderate

Rising interest in niche monitoring and customization offers entry points; however, robust sensor tech and vet data capabilities present barriers.

Buyer Power – High

Pet owners are selective, evaluating price, accuracy, battery life, and brand reputation. Institutional buyers such as vet clinics and pet care chains demand proof of reliability.

Supplier Power – Moderate to Low

Sensors and communication modules are widely sourced globally, keeping bargaining power of suppliers limited despite demand for calibrated, certified components.

Threat of Substitutes – Moderate

Alternatives include traditional collars, microchips, and basic GPS tags. Yet, demand for real-time monitoring and health data continues to differentiate wearables.

PESTEL/Regulatory Trends

-

Political & Legal: Data privacy and security standards guide device practices.

-

Economic: Steady consumer spending on pet products.

-

Social: Escalating human–pet bond and health awareness.

-

Technological: Rapid advances in IoT, AI, and sensor miniaturization.

-

Environmental: Battery longevity and recyclable materials impacting product design.

-

Legal: Certification standards needed for veterinary use and medical-grade devices.

Conclusion

The US pet wearable market is entering a transformative era—with projected growth from USD 1.04 billion (2024) to USD 2.87 billion by 2032. A rising emphasis on pet health, advanced GPS tracking, and medical-grade monitoring technologies are now mainstream.

Highlights include:

-

Dominance of smart collars and GPS-enabled devices

-

Strong growth in health and medical applications

-

Sensor technologies gaining ground

-

Rapid expansion driven by telehealth adoption and humanization of pets

-

Continued competition among global brands and specialized innovators

Outlook: As consumers prioritize their pets’ safety and wellness, pet wearables will become essential tools—not just gadgets. Manufacturers focusing on device accuracy, data privacy, and vet integration will gain lasting market advantage.

About Stellar Market Research:

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include science and engineering, electronic components, industrial equipment, technology, and communication, cars, and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Stellar Market Research:

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud, Pune,

Pune, Maharashtra, 411029

+91 20 6630 3320, +91 9607365656

Leave a Comment