Wisconsin Paycheck Calculator for Accurate Pay Estimates

Managing finances is one of the most critical tasks for anyone running a small business or working independently. For entrepreneurs and self-employed professionals, understanding exactly how much money will land in their bank account after taxes is crucial. A Wisconsin Paycheck Calculator can be a valuable tool in this regard. It allows you to estimate your take-home pay accurately, ensuring better financial planning and decision-making for both personal and business needs.

A paycheck calculator for Wisconsin is designed to take multiple factors into account. When you input your gross earnings, it automatically deducts federal, state, and local taxes. It also factors in other deductions such as Social Security, Medicare, and any voluntary contributions like retirement savings or health insurance premiums. By doing so, it provides an accurate estimate of your net income, which is the amount you will actually receive.

One of the primary advantages of using a Wisconsin Paycheck Calculator is its convenience. Instead of manually calculating taxes and deductions, which can be complex and time-consuming, the calculator performs all the math for you. This is especially useful for those who have irregular income streams, such as freelancers or small business owners. Since your income may fluctuate month to month, knowing your take-home pay in advance helps in planning expenses, savings, and investments more efficiently.

For self-employed entrepreneurs, taxes are often the most confusing aspect of managing finances. Unlike employees, business owners are responsible for calculating and paying their own taxes. A paycheck calculator Wisconsin can simplify this process by estimating the amount you need to set aside for federal and state taxes. This helps in avoiding surprises when tax season arrives and ensures you remain compliant with all tax regulations.

The calculator also allows for flexibility in accounting for different pay frequencies. Whether you are paid weekly, bi-weekly, semi-monthly, or monthly, you can adjust the calculator to reflect your payment schedule. This feature is particularly helpful for business owners who manage multiple employees or contractors. It ensures that payroll planning is accurate and consistent, reducing the risk of errors and miscalculations.

Another important feature of a paycheck calculator Wisconsin is its ability to include deductions beyond standard taxes. Many individuals contribute to retirement accounts, health savings accounts, or other voluntary programs. Including these deductions in your calculations gives a more precise estimate of take-home pay. For entrepreneurs, this clarity helps in setting budgets for business expenses, personal savings, and lifestyle choices without guessing or relying on approximate figures.

Using a Wisconsin Paycheck Calculator can also be educational. Over time, it helps you understand how different tax rates and deductions impact your net income. For instance, adjusting the number of dependents on your tax forms, or changing retirement contribution amounts, will show real-time effects on your paycheck. This level of insight empowers small business owners and self-employed individuals to make strategic financial decisions.

In addition, such calculators often provide breakdowns of each deduction. Seeing exactly how much goes toward federal tax, state tax, Social Security, and Medicare offers transparency. This transparency is useful when reviewing payroll for your business or comparing different scenarios, like hourly versus salaried income. It also makes it easier to plan for quarterly estimated taxes, which is a common requirement for self-employed entrepreneurs.

For those who manage employees, using a paycheck calculator Wisconsin can simplify payroll management. It allows you to estimate the correct withholding for each employee, ensuring compliance with federal and state laws. This reduces the administrative burden and potential for errors, allowing more time to focus on growing your business rather than worrying about payroll calculations.

Additionally, a reliable paycheck calculator can help in planning for major life events or business changes. Whether you are considering hiring new staff, increasing your own salary, or adjusting contributions to retirement accounts, seeing the impact on your net income in advance can inform smarter financial decisions. Entrepreneurs often face unpredictable expenses, and having precise paycheck estimates helps in maintaining healthy cash flow and avoiding unnecessary financial strain.

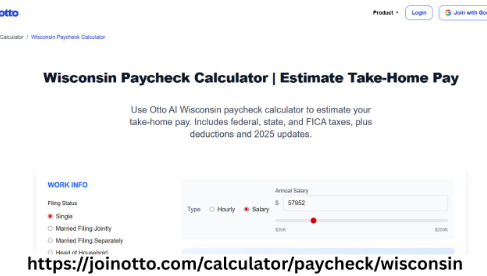

One of the standout features of using tools like Otto AI’s Wisconsin Paycheck Calculator is its simplicity and accuracy. While many people are intimidated by tax forms and deductions, a well-designed calculator simplifies the process. It does not require advanced accounting knowledge, making it accessible for anyone, regardless of their financial expertise. This is particularly beneficial for self-employed professionals who may not have a dedicated accounting team.

Moreover, keeping track of income and deductions over time is easier when using a paycheck calculator. By consistently estimating take-home pay, you can create better budgets and financial forecasts. This is essential for small business owners who need to manage expenses carefully to ensure sustainability and growth. The ability to project net income also helps in making informed decisions about savings, investments, and even expansion plans.

It is important to note that while a paycheck calculator provides accurate estimates, it may not capture every unique tax scenario. For instance, certain credits, exemptions, or special deductions might require consultation with a tax professional. However, for day-to-day payroll calculations and financial planning, a Wisconsin Paycheck Calculator is an invaluable resource that saves time, reduces errors, and improves overall financial management.

In conclusion, using a Wisconsin Paycheck Calculator is a practical step for anyone seeking clarity on their take-home pay. Whether you are a small business owner, freelancer, or self-employed entrepreneur, it simplifies the process of understanding your net income and planning your finances. Tools like Otto AI’s calculator provide accurate, easy-to-understand estimates that account for taxes and other deductions. By integrating this tool into your financial routine, you gain insight into your earnings, ensure proper tax compliance, and make more informed decisions about your business and personal finances. A Wisconsin Paycheck Calculator is more than just a tool—it is a step toward smarter, more efficient financial management.

Leave a Comment